In the ongoing tug-of-war between investment returns and inflation, how well has the TSP G Fund performed against inflation?

Since its launch in April 1987, the TSP G Fund has outpaced inflation by a significant margin. It has grown at a compound rate of 4.7% per year, while inflation over this same period has eroded purchasing power at a rate of 2.8% per year. If you had invested $1,000 in the G Fund in 1987, your investment would have grown to $5,712 today. By comparison, $1,000 in 1987 dollars and adjusted for inflation is equal to $2,836 today, as shown in the chart below:

Understanding inflation and its impact on investment returns

Inflation is the rate at which the general level of prices for goods and services rises, eroding the purchasing power of money over time. The most common measure of inflation is the Consumer Price Index for All Urban Consumers (CPI-U), which tracks the average change over time in prices paid by U.S. consumers for a broad basket of goods and services. The CPI-U is published by the U.S. Bureau of Labor Statistics, and we update this page every business day with the latest CPI and TSP data, to provide the most current comparison of inflation against investments in the TSP Funds. (Most recent update on 4/17/2025)

When assessing investment returns, it’s important to distinguish between nominal returns (the raw percentage growth of an investment) and real returns (returns adjusted for inflation). Subtracting inflation from the nominal G Fund return gives us the real return of the G Fund: 4.7% - 2.8% = 1.9% per year. This inflation-adjusted return provides a clearer picture of the G Fund’s true purchasing power over time, and helps TSP investors determine whether their wealth is actually growing or merely keeping pace with inflation.

The G Fund’s ability to outpace inflation stems from its unique structure. It earns interest at the same rate as longer-term government securities, while providing the stability of a money market fund. This means G Fund investors receive enhanced yields comparable to 4-year or longer duration Treasury bonds, but without any risk of losing principal when interest rates change — a combination unavailable to the general public.

Recent challenges (2020-present)

Despite its strong long-term performance, the G Fund has faced challenges in recent years. Following the COVID-19 pandemic, inflation surged to its highest levels in four decades, peaking at over 9% in mid-2022. The Federal Reserve initially viewed this inflation spike as ‘transitory’ and maintained near-zero interest rates well into 2022. This delay in raising rates kept the G Fund yield low while inflation accelerated, creating a significant gap between returns and inflation. When the Fed finally began aggressive rate hikes, the G Fund’s yield increased accordingly, but the delayed response caused the G Fund’s returns to lag behind inflation. As of 4/17/2025, the G Fund continues to recover but has not yet fully compensated for the inflation spike of recent years:

To be fair, this rising interest rate environment posed significant challenges for fixed-income investors. Rising interest rates cause bond prices to fall, and as shown below, the TSP F Fund lost -18.0% of its value during this period, while the G Fund continued to appreciate:

How would the G Fund have performed in the 1970s?

The U.S. has previously experienced extended periods of high inflation, such as the 1970s, when inflation remained above 9% for almost a decade. This period is relevant for today’s investors because it represents another era when inflation surprised policymakers and proved persistent. While today’s economic environment differs from the 1970s, studying this period helps us understand how the G Fund might perform if inflation remains elevated for an extended period. Let’s examine the period from January 1973 through December 1983. While the TSP G Fund did not exist then, we reconstructed its price history [1] using the same formula and interest rates published by the U.S. government. During these years, the G Fund under-performed inflation slightly, but held up rather well — especially considering that inflation was over 9% for so long — and started outperforming inflation again by 1982:

During this same period (January 1973 - December 1983) U.S. stocks, as represented by the S&P 500 (the same index tracked by the TSP C Fund) had a compound return of 8.2%, despite suffering a 42% decline in 1973-1974. By comparison, the (simulated) G Fund would have provided a compound return of 9.6%, with zero risk or drawdown:

Will the TSP G Fund protect your retirement savings from the next inflation surge?

While no one can predict how the G Fund will perform in future inflationary environments, TSP investors can gain insight by watching these important indicators:

- The starting level of interest rates when inflation begins accelerating: The G Fund faces a steeper challenge keeping pace with inflation when rates start near zero, as we saw in 2020-2022, versus periods like the 1970s when rates were already elevated. The Fed usually raises rates in small steps, whereas inflation can spike rapidly.

- The spread between short and long-term Treasury rates: Since the G Fund earns longer-term Treasury rates, a meaningful difference between short and long-term yields (known as the term premium) helps the G Fund maintain its historical advantage over other low-risk investments. Investors can look for an inverted yield curve as a potential sign of trouble.

- The government’s debt burden and its impact on rate decisions: Post-COVID federal debt levels of 120% of GDP (versus 35% in 1979) means that extended periods of high interest rates could overwhelm the federal budget with interest payments and trigger a debt crisis. In the 1970s the Fed raised rates above 20%, but this would be unsustainable for any extended period at current federal debt levels.

- The Federal Reserve’s response time in raising rates once inflation appears: Delays in Fed action, like those seen in 2021, can create periods where the G Fund return significantly lags inflation. Cost-push inflation (like supply chain disruptions or oil shocks) tends to be more challenging for the G Fund because it can cause the Fed to move cautiously with rate hikes due to economic growth concerns. Demand-pull inflation typically leads to more aggressive Fed responses and higher Treasury yields, which benefits the G Fund. Understanding the primary drivers of inflation helps predict how Treasury and G Fund yields might respond.

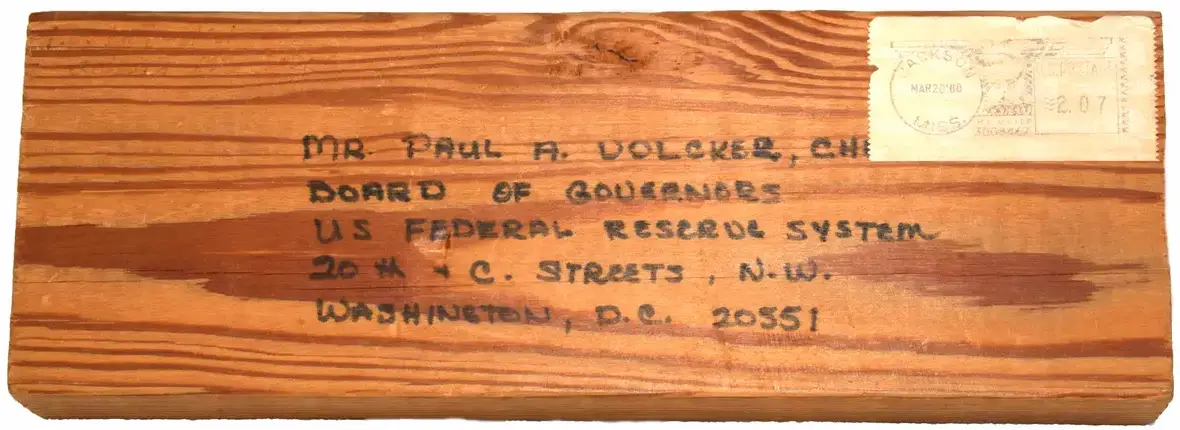

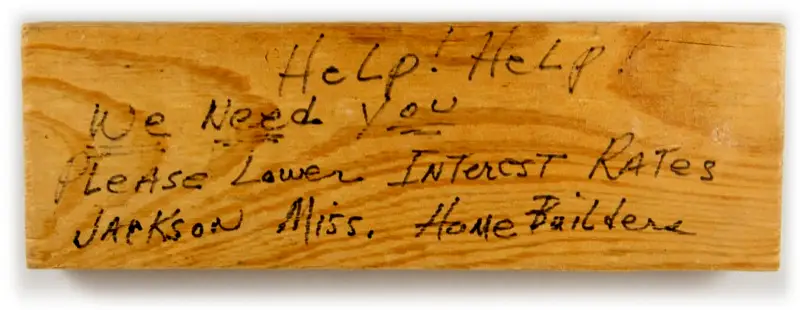

- The Fed’s ability and willingness to act decisively and independently despite social and political pressures is crucial: When Fed Chairman Paul Volcker tackled inflation in the late 1970s, he boldly raised rates above 20%, accepting a severe economic recession as the cost of breaking inflation. Today’s Federal Reserve operates under intense real-time public scrutiny, with every decision facing immediate criticism from a more partisan Congress, business leaders, social media, and market commentators. During Volcker’s time, construction industry workers mailed him actual 2x4 lumber pieces, to protest that high interest rates were devastating their industry! Today’s and future Fed chairs face digital outrage rather than physical lumber.

Final thoughts

For TSP participants, the G Fund remains a strong option for preserving capital and outpacing inflation over the long haul. Those seeking higher returns than the G Fund’s historical 4.7% per year should consider a diversified investment approach, balancing the security of the G Fund with exposure to TSP stock funds that can potentially offer greater long-term wealth accumulation. For example, since its launch in 1988, the TSP C Fund has delivered compound returns of 10.8% per year. [2]

Notes

- Our synthetic (simulated) G Fund time series is generated programmatically using the published G Fund rules and U.S. government interest rates, and tracks the actual published daily TSP G Fund prices since 6/2/2003 very closely, with a total tracking error over the entire in-sample time period of 0.166%. So while this is a hypothetical/simulated scenario, we nonetheless have high confidence about its accuracy if the G Fund had actually existed during this period.

- TSP G Fund and C Fund compound annual growth rate (CAGR) since inception. Last updated on 4/17/2025