The Thrift Savings Plan (TSP) for Federal civilian employees and members of the uniformed services is considered one of the finest retirement savings plans in the United States. The TSP has long given you the ability to make your own investment decisions, as each participant is unique and individual. But until now it did not offer the flexibility and tax treatment of a Roth option.

Currently, your TSP contributions are made on a pre-tax basis, much like those in a traditional IRA or private sector 401(k) plan. As an alternative tax strategy, the TSP is offering you the option to designate some or all of your contributions as Roth after-tax contributions. Roth TSP is not a new type of investment. Rather, it's your chance to be more tax efficient in your retirement savings. With the addition of the Roth feature, you can decide when you pay the income taxes on your TSP investments. That is, you can either pay the taxes on the way into your TSP account, or when you start taking funds out of your TSP account.

With Roth TSP, the earnings on your after-tax contributions are tax free when withdrawn, if the first Roth contribution has been in your account for at least 5 years and you're at least age 59½ or disabled, or in the case of your death.

Which TSP option is right for you?

Are you wondering if you would be better off making Roth TSP contributions? The key factor in deciding whether Roth is right for you is whether you believe you'll be paying higher or lower taxes when you withdraw the money. So give it some thought and ask yourself: is my tax rate now lower or higher than the rate I expect to pay in retirement (when I withdraw my TSP money)?

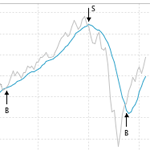

As a general rule, if you expect to be in a higher tax bracket at retirement, then you’re better off contributing to the TSP Roth (and pay the taxes now while they’re lower). Conversely, regular (non-Roth) TSP savings are generally more beneficial if you expect to be in a lower tax bracket during retirement. This is a simplistic approach: every investor’s situation is unique, and changes in tax brackets and other considerations are not trivial to evaluate. Therefore, you may want to talk to a tax advisor about your own situation. In addition, you can also try one of the many free Roth vs. regular IRA calculators available on the web, to gain a better understanding of the impact of various variables.

Remember, it doesn't have to be an all-or-nothing decision. You can always make contributions to both your “regular” TSP and TSP Roth. Think of this as “tax diversification”: no one knows for sure whether their tax rate now is lower or higher than what it’s going to be in the future. It depends on a number of variables including your future earnings and tax rates. Given this uncertainty, rather than betting on one tax scenario, why not contribute some of your savings to each account? Then as you get closer to retirement, if you have a more accurate picture of what your tax liability is going to be, contribute more to the tax-advantaged option. By contributing to both, you’re prepared for any changes that are beyond your control, such as significant changes in tax rates.

Differences between regular TSP and Roth TSP

Let’s take a closer look at the differences between the regular TSP plan and the TSP Roth option, with some examples:

- Tax-deferred vs. tax-exempt: regular TSP contributions are tax-deferred: they’re tax-deductible in the year that you make the contribution. But any money you withdraw from your TSP during retirement is taxed as ordinary income. As an example, if you contribute $5,000 of your government pay to your regular TSP account this year, you get to deposit the entire amount into your account (zero taxes are taken out). The money is allowed to grow without paying any taxes until you withdraw it during retirement. By contrast, Roth TSP contributions are made with “after tax” money: the tax is paid now before the money goes into your TSP. But after that, it is allowed to grow tax free, and you get to keep 100% of it when you withdraw it during retirement. Going back to the previous example, your $5,000 contribution is first taxed at your current rate (let’s say 25%), and the remaining $3,750 is deposited into your TSP Roth. But this $3,750 is now allowed to grow tax free, and you keep 100% of it (as well as any accumulated gains) when you withdraw your money during retirement.

- TSP fund choices: there is absolutely no difference between regular and Roth TSP contributions with regard to the available investment fund choices: both plan options will accept contributions into the same individual TSP funds (G, F, C, S, and I Fund) and Lifecycle Funds. And participants can contribute to either or both options, subject to the usual total annual limit.

- Roth conversion: traditional TSP account balances cannot be converted or transferred to the Roth option. Any existing savings in your traditional TSP account will remain there.

- Investment strategy: your regular and Roth TSP account balance can be invested according to any strategy you think is most appropriate for you, whether it’s strategic asset allocation or a tactical TSP strategy. You could of course also use strategy diversification, and apply a different strategy to part of your account balance.

The Roth TSP option is also different from a Roth IRA

There are some important differences between a Roth IRA and the Roth TSP feature. Higher income earners are prohibited from participating in a Roth IRA. This so-called “phase out” starts at an adjusted gross income of $173,000 for married couples filing jointly, or $110,000 for singles. Not so in the Roth TSP: all TSP participants can make Roth contributions, regardless of their GS pay scale or income level.

Also, whereas Roth IRA contributions are limited to $5,000 per calendar year, Roth TSP participants can contribute up to $17,000 per year to their account! These limits are raised further if you’re 50 years of age or older: in that case, you can contribute up to $22,500 per year (including the so-called “catch-up” contribution of $5,500). This is a far better deal than the limits for private sector Roth contributions.

Roth IRAs do not require that you take minimum required distributions (MRD) upon reaching age 70½, however all TSP account balances (including the Roth portion) are subject to this MRD.

Conclusion

With the new TSP Roth option, you’ll be able to choose the tax treatment that better fits your individual needs and future expectations, so you'll have the confidence that your TSP account is customized for you.